Secure file exchange for insurances

How digitalisation in the insurance industry can be successfully realised.

Data protection and compliance for data beyond your own infrastructure.

Security needs and compliance requirements for the insurance industry

In a digital world, insurance companies are facing growing demands for safer and more streamlined communications from clients as well as ever-increasing regulations, such as GDPR. Cryptshare is the practical solution for all insurance companies that are looking to facilitate simple and secure data exchange while ensuring their compliance and processes are auditable.

Cryptshare provides the encrypted path for messages and data – with no file size limits – and makes correspondence with any client or supplier secure and confidential.

It can be used anytime and anywhere; it is bidirectional, meaning your internal as well as any external correspondents can use it. Implementation is quick and easy, and your employees and insurance brokers can immediately include Cryptshare in their daily work to improve business processes.

Your entire supply chain, including prospective clients, can use Cryptshare in their exchanges with you at no additional cost and without any preconditions on their side. It is intuitive, quick, and easy to use with no training required.

All that is needed is access to the internet and a web browser.

Cryptshare QUICK Technology provides passwordless security for users and establishes permanent secure connections for regular exchanges between insurance companies, brokers, and both existing and prospective clients, streamiling digitalisation steps.

Cryptshare offers integration for MS Office 365 & Outlook as well as HCL Notes, allowing seamless use from your familiar work environment.

The Cryptshare API even enables your employees to use Cryptshare from your individual software tools and helps to digitalise processes for improved efficiency and security.

Customer Story

Stuttgarter Lebensversicherung - Customer since 2016

"It is nice to see that higher security is not necessarily complicated. With Cryptshare, we offer all employees and partners a simple solution for secure data exchange."

Cryptshare is a communication solution that serves as a user-friendly interface for analogue and digital contents of insurance clients, and it provides insurance companies security and auditability over their data.

Cryptshare can be customised to perfectly fit your needs: Its operating environment can be freely selected from various options, and its operation mode is available as a virtual appliance, hardware appliance, or as an individual configuration. With Cryptshare, all data in transit is protected from third party access.

User-friendly handling enables everyone to get in touch with insurance companies in a quick and easy way:

- no certificates

- no user accounts

- no help from IT admins required

- no data graveyard due to definable retention periods

Cryptshare’s full logging of all downloads and uploads provides clarity for everyone involved, and it reassures that the sent data has successfully arrived at the intended recipient.

For clients, this creates transparency and valuable trust, as it underscores the fact that an insurance company takes a professional and client-focussed approach in their communication.

This can be accentuated even further as an insurance company can use their corporate design for the Cryptshare’s integration into their website.

Additionally, transfer logging significantly supports quality management as it comprehensively indicates whether the most recent forms and documents for employees and their respective external contact partners have been downloaded.

Insurances benefit with Cryptshare

4.0 m

satisfied users worldwide

30

Countries

2,000 +

Corporate customers

100 %

Made in Germany

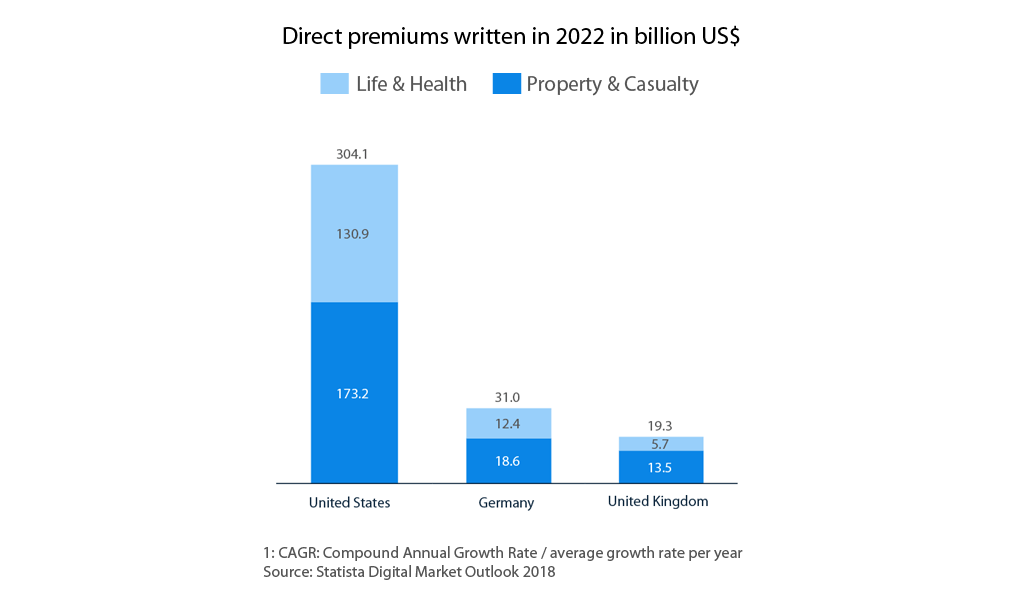

Electronic communication for insurances today

New challenges call for new solutions

Working with many customers in the insurance industry worldwide, we know that communication between insurance companies, brokers, and both existing and prospective clients alike must always be secure and as simple as possible. Being able to get in touch easily is key for any successful business relationship. By shifting their communication into the digital realm, insurance companies can ensure precisely that: Simplicity, lower costs, and improved processes.

With increasing amounts of red tape and with digitalisation taking hold, insurance companies are under pressure to modernise their internal processes to better serve their customers and changing business demands. Staying ahead requires constant exploration of, and revisions to, how business is conducted. IaaS (Insurance-as-a-Service) illustrates how all processes between insurance companies and clients can be fully digitalised.

In the insurance industry, exchanging information involves many use cases:

- Documents for insurance offers & policy contracts

- Claims & expert opinions/reports

- Changes to insurance policies

- Contracts and forms with sensitive client data

- Brochures and marketing content

In our experience, digitisation and digitalisation present enormous potential for the insurance industry as it moves from a paper-driven world to one where all the key processes are using the latest digital channels. Saving valuable time and money and making communication easier for everyone brings competitive advantage in an ultra-competitive industry. Today, independent websites compare different insurance companies’ offers in a matter of seconds, and clients are merely a few clicks away from finding a different insurance provider.

Therefore, clients demand better customer service and expect insurance companies to cater more to their needs. They increasingly shift their focus to quick, easy, and transparent communication processes. For them, communication needs to meet a certain level of expected convenience – a key factor in attracting and retaining potential clients.

Successfully digitalised processes have the additional benefit of delivering a real competitive edge. Automation for transfers helps minimise sources of errors (for example selecting the wrong document or the wrong recipient), which in turn further streamlines processes and improves competitiveness.

Those in the insurance industry who do not adapt to the changing demands will face dire consequences for their business: Poor customer experience makes it virtually impossible to win over new clients. As a result, insurance companies stand to gain in numerous ways from digitisation as well as digitalisation.

However, at the same time everyone in the insurance industry must ensure the security and confidentiality of all transferred information in their communication, for they are dealing with personal data and highly sensitive information.

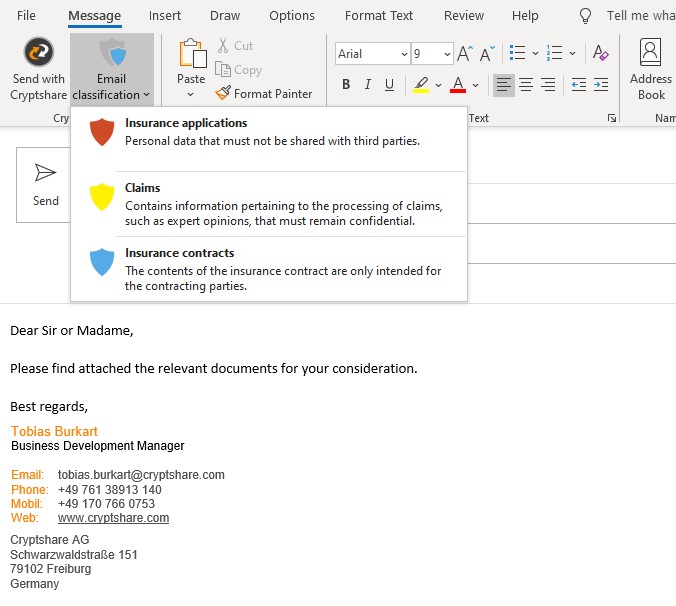

Email classifications for insurances

Cryptshare offers valuable features such as protective email classification and many efficient and comprehensive policy settings. Such settings present effective tools for preventing shadow IT and data leaks. These can be centrally defined to meet specific internal guidelines or more customised to the multi-faceted demands of the insurance industry as well as regulatory requirements for data security.

Effective tracing

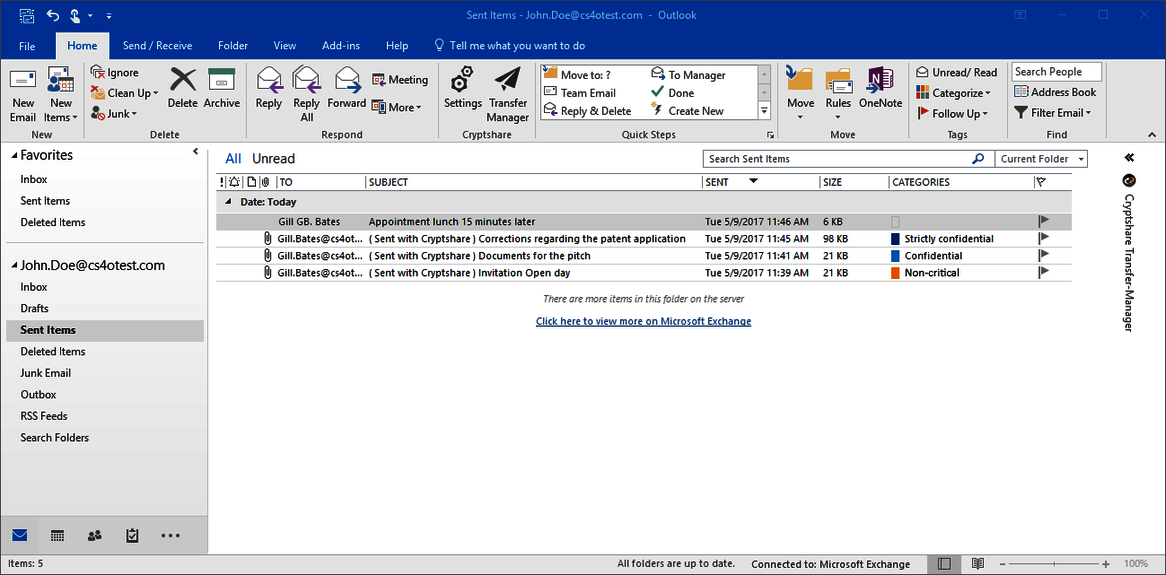

The sender can easily recognise the classification of their own messages as each protection class has clear colour coding.

In the "Sent Items" folder and in the upload manager the sender can see under which protection class their message was sent.

Automating your processes with the Cryptshare API

The Cryptshare API supports the optimisation of your work processes and serves as an effective bridge to the digital world. It facilitates an integration into your own internal systems, making the secure exchange of messages and files in your workflows even easier. Data transfers can be executed directly from your insurance tool, as the API allows for Cryptshare’s seamless integration.

This saves you valuable time on the job, streamlines your workflows, and your employees and external insurance brokers no longer need to leave their familiar work environment.

The Cryptshare API also supports a simpler administration of client data, as it can be filed by the system automatically with an integration into document management systems and archiving functions.

Insurances securing their confidential communication with Cryptshare

Our experience is that a good idea for one insurance is a good idea for many!

Advantages for insurance companies with secure communication with Cryptshare

- Encryption of email

- No size limit for transfer of files

- Logging of activities (compliance)

- No user accounts needed

- No exchange of certificates needed

- No software installation needed

- All stored files encrypted

- Secure file transfer

- LDAP Integration

- Customisable user interface design

- Self explanatory and intuitive

- Integration into MS Outlook

- Integration into HCL Notes

- Low operating effort

How insurances get the most out of Cryptshare

By using Cryptshare, insurance companies utilizes a familiar and universal channel of communication, email. Each agency can integrate their own design and messaging depending on the use case. They can boost their communication and show their correspondence between insurance companies, brokers, and both existing and prospective clients that they take data security seriously!

Want to digitise and encrypt your communication to save costs and reduce the risks of data breaches?

Want to use comprehensive and efficient policy settings to introduce your own data classification that you can roll out for all staff?

Want to use an API for automation processes or plan on integrating exchanged data in archiving functions and document management systems?

Related content

Customer Story

Secure data exchange for insurance companies

A simple approach for the secure exchange of large files and sensitive data for insurance companies

Customer Story

Digitization of healthcare

How manually and automatically encrypted mass transfers ofdata helps in terms of digitization of the healthcare system

Whitepaper

GDPR compliant email

A practical guide to getting on top of the latest changes to requirements